Oracle Receivable provides two predefined transaction types:

- Invoice

- Credit Memo.

We can create receivable transaction type by using following steps

- Sign on to the application using Receivables Super user Responsibility.

- Navigate to the Transaction Types Form

Setup / Transactions / Transaction Types

- In operating Unit field by default current operating unit is populated Vision Operations

- Enter a Name and Description for this transaction type.

Name: = XX Credit Memo

Description:-This is a Sample Credit Memo

- Enter a Class for this transaction type.

Following are the seeded classes provided by oracle

- Invoice

- Chargeback

- Credit Memo

- Debit Memo

- Deposit

- Guarantee

In credit memo case I select Credit Memo

- Open Receivable is set to Yes,

Receivables updates customer balances each time we create a complete debit memo, credit memo, chargeback,

or on-account credit with this transaction type. Receivables also include these transactions in the standard aging and collection processes.

or on-account credit with this transaction type. Receivables also include these transactions in the standard aging and collection processes.

- Check the Post to GL box

To be able to post transactions with this type to general ledger.

The default is the value specified for the Open Receivables option. This box must be checked if the class is Deposit or Guarantee.

The default is the value specified for the Open Receivables option. This box must be checked if the class is Deposit or Guarantee.

- Choose Print. We can override this value when entering transactions in transaction window.

- Choose Transaction Status of Open from open, Closed, Pending, or Void.

Use these statuses to implement our own invoice approval system. Enter 'Void' to void debit memos, on-account

credits or invoices to which we want to assign this transaction type.

credits or invoices to which we want to assign this transaction type.

- Check the Allow Freight box.

Allow freight to be entered for transactions with this transaction type

- Check the Tax Calculation box.

Receivables calculate tax for transactions with this transaction type.

If we do not check this box, the Tax Code field in the Lines window will not be required and Receivables

will not perform tax calculations or create tax accounting entries for transactions with this

transaction type (this is also applicable for transactions in Oracle Order Management).

If we do not check this box, the Tax Code field in the Lines window will not be required and Receivables

will not perform tax calculations or create tax accounting entries for transactions with this

transaction type (this is also applicable for transactions in Oracle Order Management).

- Choose Creation Sign Negative.

The default is Positive Sign for transaction types with a class of either Guarantee or Deposit.

If we are using the Cash Basis accounting method, Transaction's creation sign must be Positive Sign, Negative Sign, or Any Sign.

We cannot update this field after entering transactions with this type.

If we are using the Cash Basis accounting method, Transaction's creation sign must be Positive Sign, Negative Sign, or Any Sign.

We cannot update this field after entering transactions with this type.

- Select the Natural Application Only check box. We cannot update this option after save this transaction type.

- Enter the Receivable Account for transactions with this transaction type.

Receivables use this information, along with Auto Accounting definition, to determine the receivable accounts

for transactions with these types.

Receivables creates a receivables transaction record using this account so we can transfer to general ledger and

create a journal entry if Post To GL is Yes for this transaction type.

- Enter receivable account “Accounts Receivable” .

Receivables does not require entering a Receivable account for Credit Memo transaction types if the profile option Use

Invoice Accounting for Credit Memos is set to YES otherwise, must enter a Receivable Account.

- Enter a Freight Account for transactions with this transaction type.

Receivable uses this information, along with Auto Accounting definition, to determine the freight account for transactions with this transaction type.

- Enter Revenue Account Receivables does not require to enter a Revenue Account for Credit Memo transaction

types if the profile option Use Invoice Accounting for Credit Memos is set to YES. Otherwise, must enter a Revenue Account.

- As this is a credit memo so we need to define UNBILLED RECEIVABLE ACCOUNT.

Receivable uses this information, along with Auto Accounting definition, to determine the Unbilled Receivable

account for transactions with this transaction type.

Receivable only uses the Unbilled Account field to determine the Unbilled Receivable account for invoices with the rule Bill in Arrears.

- Enter an Unearned Revenue Account. Receivable uses this information, along with Auto Accounting

definition, to determine the unearned revenue account for transactions with this transaction type.

Receivable only uses this account when transaction's invoicing rule is Bill In Advance.

- Enter a Tax Account. Receivable uses this information along with Auto Accounting

definition to determine the tax account for transactions with this transaction type.

- Save this credit memo transaction type now.

- Navigate to the Transaction Form

Transaction Transactions

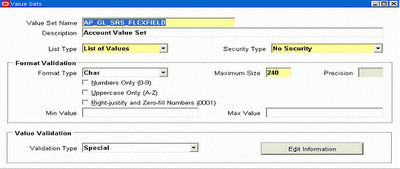

Look in above screen shot I have select XX Credit Memo Type